🗞️ News & Moves 🏠

The U.S. commercial real estate market just posted its strongest quarterly performance since the pandemic shakeout, with transaction volume jumping 17% year-over-year in Q3 2025. Office deals led the surge at 38%, while retail and industrial climbed 24% and 7% respectively. The MBA reported debt originations up 55% through mid-year, signaling lenders are finally opening their wallets again after two years of sitting on the sidelines. If Q4 activity matches late-2014 levels near $136 billion, total 2025 volume could land roughly 10% above last year, another sign that liquidity is returning and the market's finding its footing after a brutal reset.

Commercial mortgage delinquencies pulled back slightly in Q3 2025 after spiking the prior quarter, though the MBA's latest data shows the pain is far from over. CMBS loans are bleeding worst with 5.66% of balances 30+ days delinquent (up from 5.14% last quarter). Multifamily and healthcare saw delinquencies climb despite the overall decline, underscoring that even traditionally stable asset classes aren't immune to today's rate environment and operating pressure. For investors, the message is mixed: things aren't getting dramatically worse, but later-stage delinquencies and foreclosures remain elevated enough that lenders are still working through the wreckage from 2023-24's valuation reset.

🚨The Fed Pulse🚨

U.S. 5 Year Treasury | U.S. 10 Year Treasury | Fed Funds Rate |

|---|---|---|

3.71% ⬆️ | 4.09% ⬆️ | 3.87% ⬇️ |

The Federal Reserve just delivered its second consecutive quarter-point rate cut, dropping the benchmark to 3.75-4% in a 10-2 vote (the lowest short-term borrowing costs in three years). The back-to-back cuts follow five straight pauses to open 2025 after three cuts in late 2024, marking a clear pivot from the 5.25-5.5% plateau that strangled CRE financing from mid-2023 through September 2024. The Fed didn't signal whether more cuts are coming, leaving commercial real estate borrowers and investors in wait-and-see mode heading into year-end. For CRE players, lower rates should ease refinancing pressure and boost transaction activity in 2026. The tepid guidance, however, suggests the days of aggressive easing are likely behind us (at least for now).

🏢 Chicago CRE Insider 📈

East Coast distressed asset specialists are doubling down on Chicago's battered Loop office market. NY-based Namdar Realty Group and Mason Asset Management are in advanced talks to acquire 190 S. LaSalle (the 798,792-square-foot tower that's 80% leased but bleeding major tenants) for substantially less than the $70 million a previous buyer offered (Beacon Capital paid $230 million for it in late 2019). This marks the duo's third Loop office grab in 16 months after seizing 1 N. LaSalle and picking up 70 W. Madison out of foreclosure, betting that the post-pandemic carnage has bottomed out. For CRE investors watching secondary markets, it's a classic distressed playbook: buy properties at 70-80% discounts from peak prices, ride out near-term lease rollover pain, and hope the recovery timeline beats the carrying costs.

This might sound familiar:

You're underwriting a deal in a new market, and you need to know what the property leases for.

You need to know what cap rate moves the property, and you need to know fast (because someone else is probably circling the same deal).

So you pull comps. You scroll CoStar. You get a sense of the numbers... but not the full picture.

The missing piece is talking to the top brokers. The ones who actually write the leases. The ones who know if your repositioned property will lease at $12/SF or $14/SF. The difference between a 7-cap and an 8-cap exit.

But CoStar doesn't give you a ranked list of brokers. You get comps, sure. But figuring out who did the most deals is a much heavier, more manual lift.

I used to hand this off to my assistant. She'd unpack the list (listing broker, tenant broker, deal size) then rank them by volume.

But took 2+ hours! Sometimes even longer. There was almost no chance I’d get it same-day.

That delay kills speed. And in this business, speed is everything.

Then I Found The Hack

I've tried every LLM out there: ChatGPT, Claude, Gemini, Grok.

None of them could pull broker contact info from transaction data reliably.

Until I tried Manus AI.

I was chasing a small-bay industrial deal in San Antonio. Didn't know the market. Didn't have leasing comps dialed in. So I pulled all the comps from the last 24 months in CoStar.

Normally, I'd screenshot those comps, send them to my assistant, and wait.

This time, I opened Manus AI and dropped in this prompt:

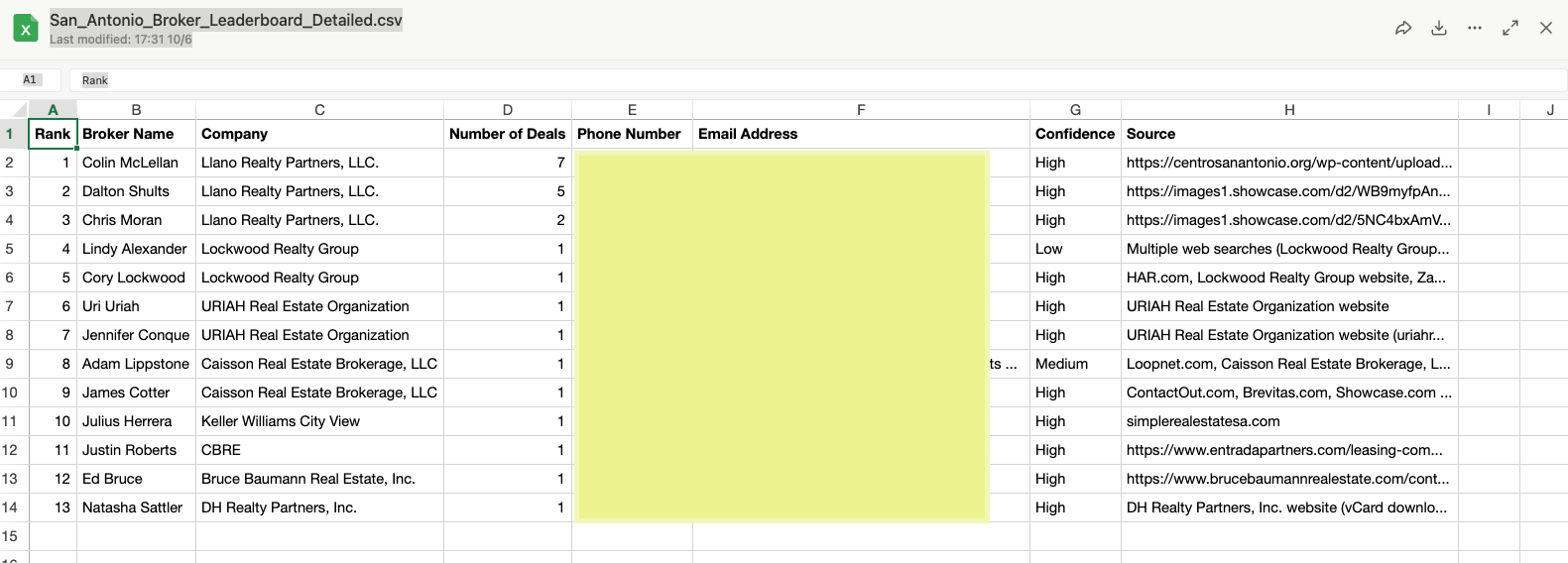

"Create a leaderboard of the most active leasing brokers in San Antonio based on these recent commercial leasing transactions. Include broker names, phone numbers, and email addresses."

I uploaded the screenshots, and three minutes later…

I had a ranked Excel sheet with names, phone numbers, and emails. Sorted by deal volume.

All of the top brokers in San Antonio, ready to call.

It was magic. And I could do it 10 times in a day if I wanted to.

What Happened Next

I called all three top brokers within the hour. All three picked up.

By the end of that day (less than 2 hours total) I had leasing comps validated, pricing expectations set, and a clear sense of where the market was moving.

A task that normally takes two days was done before lunch.

Speed matters.

The faster you validate assumptions, the faster you decide.

The faster you decide, the more deals you see.

The more deals you see, the better your picker gets.

How You Can Do It

Here's the step-by-step:

Go into CoStar (or Crexi).

Filter for leased comps in your target market.

Screenshot the comp pages. Make sure the property address, price, and date are captured.

Open Manus AI and paste this prompt:

"Create a leaderboard of the most active [leasing/sales] brokers in [CITY] based on these recent commercial transactions. Include broker names, phone numbers, and email addresses."Upload your screenshots.

Wait 3 minutes.

Call the top 3 brokers, build the relationship, and get the intel.

That's it.

You don't need luncheons or guesswork.

The brokers doing the most deals know the pricing, they know the tenants, and they know what's moving and what's sitting.

And now you can find them in under 5 minutes.

Who This Is For

If you're buying deals in a market you don't have a pulse on yet, this is for you.

If you're trying to build relationships with the top 3–5 brokers fast, this is for you.

If you've been manually building these lists or waiting on your assistant, this is definitely for you.

You don't need a huge network to start buying deals. You just need the right 3 brokers. And now you can find them before lunch.

Go try it out, and let me know how it works for you.